Stock market and real estate are two ways to get rich. They are often at odds with each other. The French tend to favor real estate because it is considered a safe investment.

In the Elabe study, 70% of French people said they would choose real estate if they received a large sum of money (Source : Boursorama). In 2018, real estate represented between 51% and 77% of the wealth of the middle class (Source : Insee).

What is the situation in reality? Is real estate more interesting than the stock market ? Let’s try to compare these two investments.

Advantages and disadvantages of investing in the stock market– Stock market or real estate

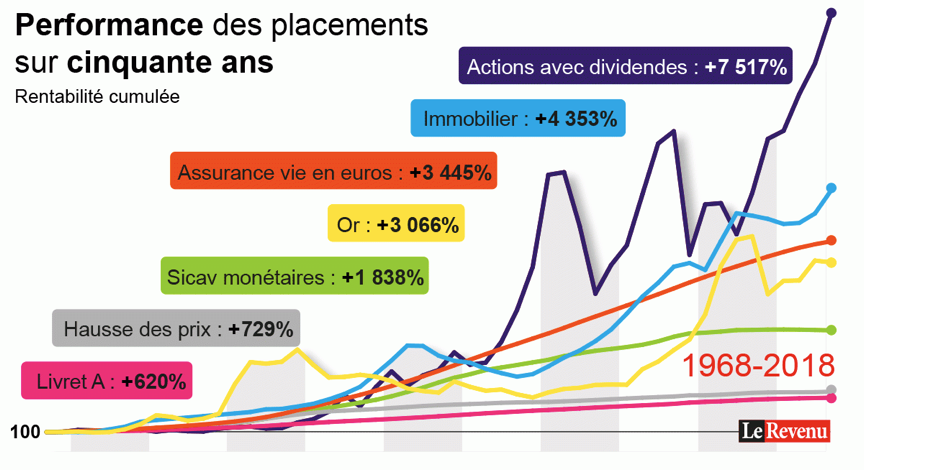

The stock market is the most profitable investment from 1968 to 2018. The average return on the stock market is about 9.05% per year from 1968 to 2018 because (1 + 9.05%)50 equals about 7517% due to compounding. Compound interest is a formula that uses past interest to calculate future interest. Your capital earns you interest, which earns you interest, and so on. Therefore, it is advisable to invest over a long period of time to take advantage of the power of compounding.

Compound interest is the most powerful force in the universe

Albert Einstrein

Past performance is not a guide to future performance, but statistically, the average long-term return on the stock market is between 8% and 10%.

The financial markets make it possible to build a geographically and sectorally diversified portfolio using ETFs. An exchange-traded fund (ETF) allows you to invest in a group of financial securities. For example, the CAC 40 ETF is composed of the forty largest French capitalizations. LVMH represents 11.7% of this fund.

Diversification generally reduces portfolio risk at the expense of performance.

Stocks are also highly liquid. Stocks are easy to buy and sell. You can get your investment back very quickly if you need it. However, volatility is a downside of the financial markets. It means that your wealth can change suddenly, but over a long period of time, the risk associated with stock market fluctuations is reduced.

Advantages and disadvantages of investing in rental properties– Stock market or real estate

The main advantage of investing in real estate is the ability to use bank leverage. This leverage allows you to buy a house on credit in order to build up future capital. Usually in France, the banker will ask you for at least a 10% deposit to get your real estate project. You buy a property to rent and the monthly payments on your loan are covered by your tenant. If your investment is successful, the income generated by your property will exceed your monthly debt.

Buying real estate is reassuring because, unlike the stock market, it is a tangible asset. That is, it is an asset you can touch. You finally own a piece of land. You can rent it out to generate income, but you can also use it in case of problems. But you won’t be able to sell your property quickly in case of emergency. The average yield of the Paris real estate market is about 7.89% per year from 1968 to 2018 as (1+7.89%)50 is about 4353% (Source : LeRevenu).

The performance gap between dividend stocks and real estate must be put into perspective. It does not take into account the income generated by the rental of a property or the leverage effect of the bank.

I don’t want to sell you dreams. The return on your property will depend mainly on where it is located and the work you do on it. The performance shown is an average that will probably decrease over time. You can’t rely on this parameter alone because you are investing in a property and not in the Paris real estate market as a whole.

Case Studies – Stock market or real estate

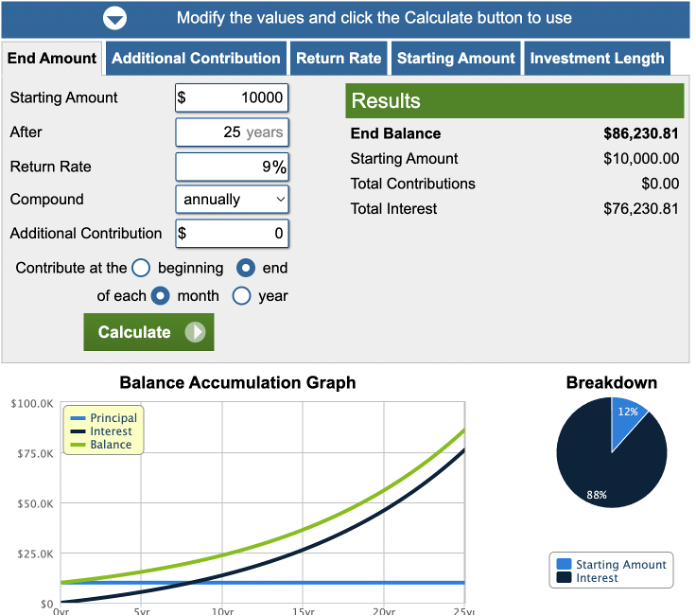

Case Study #1:– Stock market or real estate

Pierre wants to invest €10,000 in the stock market. The average return on the financial markets is assumed to be 9% per year. Here is an overview of his portfolio after 25 years.

After 25 years, Pierre’s financial assets will be worth €86,230. He will have realized a capital gain of €76,230. The return on his investment will be 765.3% ((86 230 – 10 000)/10 000).

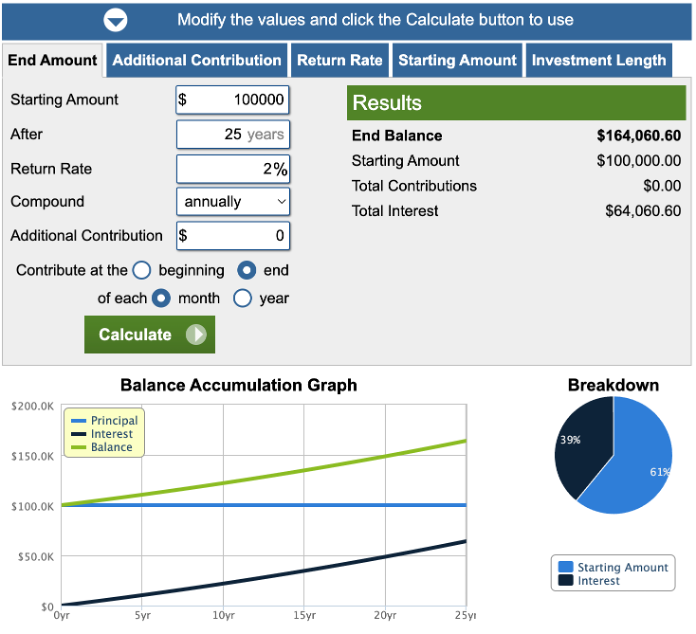

Case study #2:– Stock market or real estate

Pierre wants to buy an apartment worth €100,000. His real estate project is valued at €110,000 (price of the property + notary fees + management fees). He borrows €100,000 from his banker for 25 years and makes a down payment of €10,000, i.e. 10% of his project. It is assumed that the property will appreciate at 2% per year and that it will be self-financing, i.e. the monthly payments on his loan and other charges will be paid by his tenant. Here is an estimate of the value of his property in 25 years.

After 25 years, Pierre’s wealth will be valued at €164,060. He will have realized a capital gain of €154,060 (€164,060 – €10,000). The return on his investment will be 1540.6% ((164 060 – 10 000)/10 000).

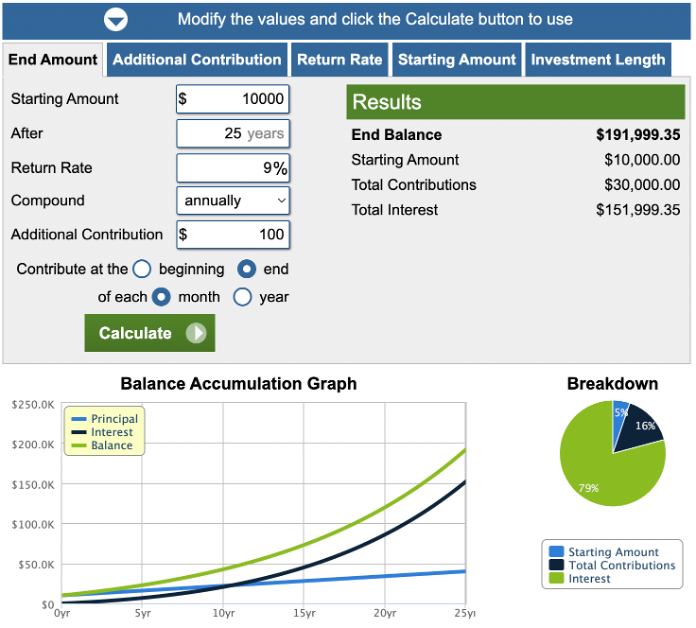

Case study #3:– Stock market or real estate

Pierre invests €10,000 in the stock market. Each month, he will add $100 to his portfolio. The average return on the financial markets is assumed to be 9% per month. Here is an overview of his portfolio after 25 years.

After 25 years, Pierre’s assets will be valued at €191,999. He will have realized a capital gain of€151,999. The return on his investment will be 380% ((191,999 – (10,000 +100×12×25) /(10,000 +100×12×25)).

Case study #4:– Stock market or real estate

Pierre wants to buy an apartment worth €100,000. His real estate project is valued at €110,000. He borrows €100,000 over 25 years from his banker and makes a down payment of €10,000. It is assumed that the property will appreciate by 2% per year and that his project will not pay for itself. Each month, Peter will have to add €100 to pay off his mortgage.

Pierre’s property will be valued at €164,060 after 25 years. He will have made a capital gain of €124,060 (€164,060 – (10,000 +100×12×25)). The return on his investment will be 310.2% ((164,060 – (10,000 +100×12×25))/(10,000 +100×12×25)).

From a purely financial point of view, it seems more interesting to invest your money in real estate than in the stock market, if you are able to find a profitable property. It is quite possible to build up a financial portfolio with an average return of more than 9% per year, I talk about this in my book “Investing in the stock market like a pro”. However, only a minority of investors manage to “beat the market” over the long term.

| Case Study | 1 (the stock market) | 2 (real estate) | 3 (the stock market) | 4 (real estate) |

| ROI | 765,3% | 1540,6% | 380% | 310,2% |

Conclusion : Should you prefer to invest in the stock market or in real estate ?– Stock market or real estate

As you can see, there is no simple answer to this question. It depends on your situation and your preferences for the stock market or rental property. For example, I think it would be more interesting for someone with a small capital to start investing in real estate in order to benefit from the leverage effect of the bank.

However, there is nothing stopping you from investing in both once you have seriously studied both disciplines. If you have a stable income, you can take the opportunity to buy a property on credit and rent it out. You can also invest some of your capital in the stock market to protect it from inflation, the loss of purchasing power of money.

Personally, I invest in both of these types of assets, but I prefer to put my money in the financial markets because with just a few clicks I can manage my portfolio without the constraints of the physical world.

- No paperwork;

- No travel;

- No construction or renovation;

- My financial assets can easily move from one country to another;

- etc.

To be successful in the financial markets, you need to develop a good strategy, learn to manage your emotions and be patient.

Regarding rental property, you have to approach it as a business and not as a completely passive investment. In case of unforeseen events, even if you entrust the management of your property, you will have to step in to solve the various problems.