Who creates money?– The impact of inflation on savings

In 1971, the then United States President, Richard Nixon, put an end to the parity between gold and the dollar. This meant that the quantity of money was proportionate to the quantity of gold in the central and commercial banks coffers on the one hand, and that other currencies had a fixed exchange rate with the dollar, on the other.

Central banks currently oversee the creation of currency. The Federal Reserve (FED) for the dollar, the People’s Bank of China (PBC) for the yuan and the European Central Bank (ECB) for the euro. These central banks set the key interest rates, i.e. the interest rates from day to day.

These interest rates are charged by commercial banks (e.g. BNP Paribas) to their customers when they borrow money. The objective of central banks is to keep inflation low, at around 2% per year.

What is inflation?– The impact of inflation on savings

Inflation is the loss of purchasing power of currency. It is expressed as a general and persistent rise in prices. It is due to an increase in the quantity of currency relative to the quantity of goods and services available in the economy.

For example:

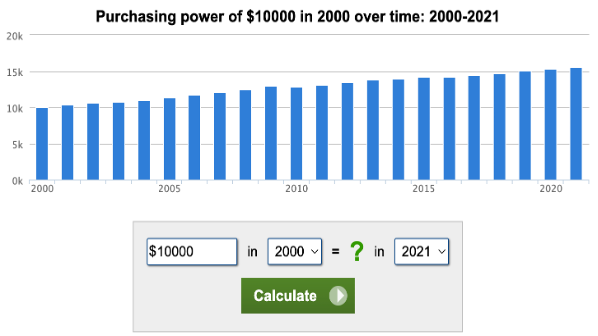

On 1st January 2000, Isabelle saved $10,000 in her current account. On 31st December 2021, the amount in her bank account has not changed, but her purchasing power has decreased significantly. She would need $15,545.86 on 31st December 2021 to have the same purchasing power as she had with $10,000 on 1st January 2000. In reality, Isabelle’s wealth has fallen by about 55.46 %, or an invisible tax of $5,545.86.

How to protect yourself from inflation ?– The impact of inflation on savings

Assets put money in your pocket, whether you work or not, and liabilities take money from your pocket.

Robert Kiyosaki

In order to protect your assets from the effects of inflation, you may want to invest a portion of your savings in assets. An asset is an economic resource held by an individual or a company for the purpose of making a profit.

Here is a list of examples of assets:

- Rental property;

- Stock market;

- Private equity (start-ups) ;

- Precious metals (physical gold, physical silver, etc.);

- Cryptocurrencies;

- Works of art;

- Wine;

- Collectibles (luxury watches, trading cards, etc.).

Conclusion– The impact of inflation on savings

It may seem safe to leave your money in a checking or savings account, but the reality is that your savings will depreciate year after year.

One solution to this problem is to invest some of your wealth in assets so that the gains you make will offset the depreciation of the currency.

In this blog we will focus on investing in the stock market.