Mastering the art of financial management is an essential skill that can prove challenging for many people. Some choose to entrust their financial affairs entirely to a trusted professional, such as a portfolio manager or financial advisor. However, this choice is not without its potential pitfalls.

In this article, we examine the risks associated with delegating your financial management and emphasize the importance of maintaining an active role in your personal financial affairs.

1 – Risks associated with fraud and breach of trust– Trusting Your Finances

The realm of finance is not devoid of scams and instances of misplaced trust. Entrusting your complete financial matters to an intermediary leaves you vulnerable to such risks. Unscrupulous individuals and scammers frequently exploit their victims’ naivety or limited knowledge to swindle money. For instance, renowned athlete Usain Bolt lost $12 million by investing in a fraudulent investment company (Source: CNN).

By taking an active role in your financial management, you can develop the acumen to recognize warning signs, including Ponzi schemes, implausible returns, and excessive management fees. It is important to recognize that scammers often use manipulative psychological tactics to gain your trust.

2 – Risks related to dependence and loss of control– Trusting Your Finances

When you delegate your financial affairs to a third party, you relinquish some authority over your investments and savings. While this may feel like a burden lifted, it can also make you completely dependent on that person or firm, for better or worse. The chosen portfolio manager may lack the necessary expertise or competence to handle your finances skillfully.

By expanding your financial knowledge and honing your skills, you can effectively evaluate the advice you receive and make informed decisions about your investments.

How can you quickly improve your skills?– Trusting Your Finances

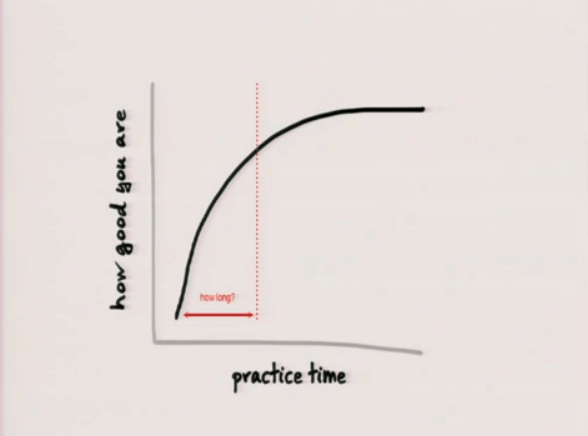

Malcolm Gladwell, author of “Outliers: The Story of Success,” claims that it takes about 10,000 hours of dedicated practice to become an expert in a field. However, you do not need to be a financial expert to start investing in the stock market.

Josh Kaufman, in his book “The First 20 Hours: How to Learn Anything … Fast!”, asserts that as little as 20 hours is sufficient to achieve proficiency in a discipline. He suggests breaking the skill down into sub-skills, acquiring enough knowledge to self-correct, and engaging in mindful, focused practice. By following these guidelines, one can achieve a satisfactory level of competence in any field.

Conclusion– Trusting Your Finances

Entrusting all of your financial affairs to an intermediary may seem attractive, but it is important to understand the potential dangers of such a decision. Fraud, trust, and the competence of the trusted third party can each undermine your financial well-being. By taking an active role in your financial management and cultivating your skills, you can mitigate these risks while remaining in control of your financial destiny.